Founded in 2012, Encito Advisors is a boutique investment bank ensuring our planet’s long term sustainability by driving transformative capital into global climate action.

The name Encito is inspired by the Latin word incito, meaning to accelerate or inspire. We replaced the “i” with an “e” to reflect our singular focus on energy, environment, and entrepreneurship — the pillars of climate action.

All exclusively within climate-aligned sectors such as clean energy, e-mobility, environment, cleantech, and sustainability.

Encito has been featured multiple times in the Venture Intelligence Top-15 League Tables over the past decade and specializes in mid-sized strategic and financial transactions ranging from $5M to $200M. For larger transactions we partner with the Big-4 or Bulge bracket IB’s.

across climate action subsectors

VCs, PEs, family offices, DFIs, banks

enCore powering speed and smarter decisions

engagement, negotiation, diligence, closure

on alignment, scale, real outcomes

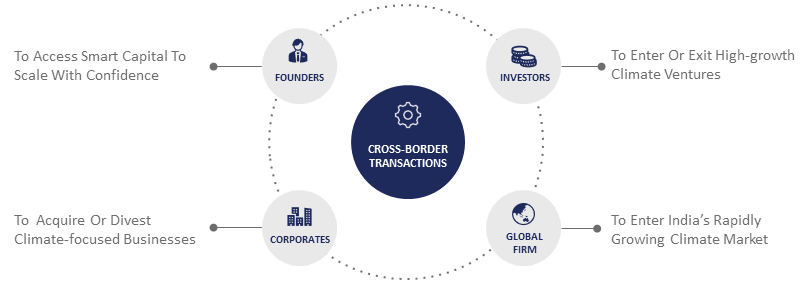

To access smart capital to scale

with confidence

To enter or exit high-growth

climate ventures

To acquire or divest climate-

focused businesses

To enter India’s rapidly growing

climate market

where one leg of the transaction

is in India and the other abroad

To access smart capital to scale with confidence

c

Where one leg of the transaction is in India and the other abroad

To enter or exit high-growth climate ventures

To enter India’s rapidly growing climate market

To access smart cap-ital to scale with contidence

To acquire or divest climate-focused businesses

To enter or exit high-growth climate

ventures

To enter India’s rapidly growing climate market

Our edge lies in deep research. Before taking on any mandate in a new sub-sector, we invest 3 to 12 months in primary and secondary research

— covering technology, business models, market sizing, investor appetite, exit trends, andeven unit economics. This research

isn’t sold — it powers our ability to identify scalable companies, credible investors, and accelerate execution.

across climate action subsectors

k of VCs, PEs, family offices, angels, DFIs, and banks

across counterparty engagement, negotiating term sheets and SHA’s, managing complex due diligence, and deal closure

enCore, powering speed and smarter decisions

Prashant Maniar founded Encito Advisors in 2012 with a singular conviction — that transformative capital must be directed into climate action to secure a sustainable future. He brings over 30 years of experience across clean energy, environment, and technology, combining technical depth with financial acumen and a global perspective.

Prashant specializes in structuring and closing complex cross-border climate transactions — where capital, technology, and companies flow between India and global markets. His expertise spans fund raising, M&A, and India entry, enabling international investors, corporates, and family businesses to access high-growth opportunities in India’s climate sector with confidence and clarity.

Clients value his ability to:

Known for his integrity, sharp negotiation style, and long-term client relationships, Prashant ensures that every deal creates lasting value beyond the transaction itself.

He holds an MBA in Entrepreneurship from Santa Clara University, USA, a Master’s in Electrical Engineering from the University of South Carolina, USA, and a Bachelor’s in Electronics Engineering from Mumbai University, India.

Prashant has been a speaker at marquee climate and investment conferences, a contributor of thought

pieces on sustainability and capital markets, and a mentor to emerging entrepreneurs.

Beyond Encito, Prashant contributes actively to the entrepreneurial and sustainability ecosystem through his not-for-profit roles:

Stay updated with curated insights across climate-tech, energy, circular economy, and market entry — concise, data-rich, and relevant to decision-makers.

Copyright © Encito Advisors LLP 2025.